Wednesday, December 17, 2008

5 Myths Banks Want You to Believe

MYTH No.1

Banks and brokers are repaying investors for the money they lost

MYTH No.2

Both issuing banks and distributors are to blame for losses

MYTH No.3

Based on the high returns, people should have known they were getting into a high-risk investment

MYTH No.4

Issuing bank don’t gain from investors’ losses

MYTH No.5

Sellers are returning investors’ money

Want to know the real stories behind the myths? Go here:

5 Myths Banks Want You to Believe

.

Saturday, November 29, 2008

IN MEMORIAM - Ms Lo Hwei Yen

Ms Lo Hwei Yen, just 28-years old was killed in the Mumbai terrorist attacks in the past week.

Ms Lo Hwei Yen, just 28-years old was killed in the Mumbai terrorist attacks in the past week.India is not very far away, but it is still a very rude shock when these senseless acts of violence wash up on our shores.

We send our condolences to the families of Ms Lo and her husband Mr Michael Puhaindran.

Thursday, November 27, 2008

Asian pensioners are the latest victims of Lehman’s bankruptcy

WHEN Hank Paulson, America’s treasury secretary, let Lehman Brothers fail in September, he surely did not consider the damage the investment bank’s collapse would inflict on elderly savers a continent away. In Hong Kong, Singapore and Taiwan, thousands of people have taken to the streets to protest against the implosion of a series of retail securities which resulted from the bankruptcy.

| |

| | |

| The backlash begin |

Banks and regulators were taken off guard and are only now totting up the damage. Singaporean authorities estimate that 11,000 residents held duff securities with a face value in excess of S$530m ($347m). In Hong Kong, 43,700 residents held HK$20.1 billion-worth ($2.6 billion). In Taiwan, 51,000 people had tainted holdings of NT$40 billion ($1.2 billion). Some Taiwanese are expected to stage a mass protest on November 29th.

Although many different securities were affected, they shared a common trait: fiendish complexity. One firm would arrange the structure and handle dividend payments. This was often Lehman, which was why they were commonly called “Lehman minibonds” (even though they were not bonds and were never simply Lehman obligations). Below the arranger were half a dozen or so “reference” banks which held collateralised-debt obligations and sometimes equity, issued by as many as 100-150 institutions.

From 2006 onwards, banks and brokers sold these now troubled securities to individuals desperate to earn more than the 1% or less on guaranteed deposits. Buyers were betting on modest returns, typically 5-6%, low enough perhaps for them not to have been too suspicious about the instruments’ complexity.

Lehman’s bankruptcy filing undermined its ability to pass along dividends even when the underlying structures were sound, which triggered the first defaults. Securities arranged by Merrill Lynch and DBS Bank in Singapore then collapsed because Lehman credit was an ingredient in their composition.

Inevitably, lawsuits will be filed. Because most securities were sold with lengthy prospectuses that made clear the lack of principal protection, the cases are likely to rest on the premise that the investments were unsuitable for the customers, or not understood by the salespeople.

Rather than waiting for messy court battles, Singapore has taken the novel step of asking firms to reimburse “vulnerable customers”, meaning those who are old or illiterate or who lost a lot. Authorities plan to investigate and say they will take into account how generously institutions treat their customers in the aftermath.

Behind the scenes, Singaporean authorities are also attempting to find a way to reconfigure the securities to capture the value of the underlying collateral. This kind of twin-track approach may hold appeal for governments around the region. Wealthy investors across Asia are sitting on vast losses from lots of other odd financial products created during the boom. The authorities would hate them to take to the streets, too.

.

Sunday, November 23, 2008

Our Reply to Mr Chua

We refer to Mr Chua Sheng Yang’s letter on Saturday, “The aim of my letter was not to question the genuine intent of Mr Tan Kin Lian”. Any reasonable person reading his earlier letter would have come away with the impression that that was exactly what he was doing.

But we are not writing to defend Mr Tan as he is well able to do that himself. Rather we take issue with Mr Chua’s claim that there are many people seeking redress when there has been no injustice done in the first place. We would like to ask Mr Chua how familiar he is with the issues of the collapse of the Lehman-related products such as Minibonds and DBS High Notes.

Recently we have carried out a data gathering exercise among High Notes 5 (HN5) investors. Preliminary findings show a consistent pattern of customers being told at the point of sale that HN5 is low risk and safe, something that does not match DBS’ recent public admission that the product has a risk rating of “8 to 9” on a scale of 1 to 10.

Now, Mr Chua could well say that investors may be asserting this only because HN5 has collapsed. But would he also contend that a reasonable retail customer, if given all correct information, would still risk his entire investment in such a risky product in return for a mere 5% in annual interests? And would Town Councils also knowingly invested public funds, especially given that they are not aggressive investors?

To us, there are systemic failures in the product, in the selling process and in the targeting of customers. Therefore it matters not if the investors were professionals, or business people, or in fact, organizations like Town Councils. All of them have been similarly misled into the nature of what they bought because the risks are not commensurate with the returns.

High Notes Investor Group Committee

.

Tuesday, November 18, 2008

We Are Not Alone - Town Councils were also "Greedy"

The town council invested 6.7 per cent of its sinking funds available for investment in Lehman Brothers' Minibond Notes, DBS High Notes 5 and Merrill Lynch's Jubilee Series 3 Notes.

Full article here : Two town councils invested S$12m in Lehman-related structured products

.

How HN5-like Products are Set Up

Here’s how it works: a bank will set up a shelf company in Cayman Islands or somewhere with $2 of capital and shareholders other than the bank itself. They are usually charities that could use a little cash, and when some nice banker in a suit shows up and offers them money to sign some documents, they do.

That allows the so-called special purpose vehicle (SPV) to have “deniability”, as in “it’s nothing to do with us” – an idea the banks would have picked up from the Godfather movies.

The bank then creates a CDS between itself and the SPV. Usually credit default swaps reference a single third party, but for the purpose of the synthetic CDOs, they reference at least 100 companies.

The CDS contracts between the SPV can be $US500 million to $US1 billion, or sometimes more. They have a variety of twists and turns, but it usually goes something like this: if seven of the 100 reference entities default, the SPV has to pay the bank a third of the money; if eight default, it’s two-thirds; and if nine default, the whole amount is repayable.

For this, the bank agrees to pay the SPV 1 or 2 per cent per annum of the contracted sum.

Finally the SPV is taken along to Moody’s, Standard and Poor’s and Fitch’s and the ratings agencies sprinkle AAA magic dust upon it, and transform it from a pumpkin into a splendid coach.

The bank’s sales people then hit the road to sell this SPV to investors. It’s presented as the bank’s product, and the sales staff pretend that the bank is fully behind it, but of course it’s actually a $2 Cayman Islands company with one or two unknowing charities as shareholders.

It offers a highly-rated, investment-grade, fixed-interest product paying a 1 or 2 per cent premium. Those investors who bother to read the fine print will see that they will lose some or all of their money if seven, eight or nine of a long list of apparently strong global corporations go broke. In 2004-2006 it seemed money for jam. The companies listed would never go broke – it was unthinkable.

Here are some of the companies that are on all of the synthetic CDO reference lists: the three Icelandic banks, Lehman Brothers, Bear Stearns, Freddie Mac, Fannie Mae, American Insurance Group, Ambac, MBIA, Countrywide Financial, Countrywide Home Loans, PMI, General Motors, Ford and a pretty full retinue of US home builders.

In other words, the bankers who created the synthetic CDOs knew exactly what they were doing. These were not simply investment products created out of thin air and designed to give their sales people something from which to earn fees – although they were that too.

They were specifically designed to protect the banks against default by the most leveraged companies in the world. And of course the banks knew better than anyone else who they were.

As one part of the bank was furiously selling loans to these companies, another part was furiously selling insurance contracts against them defaulting, to unsuspecting investors who were actually a bit like “Lloyds Names” – the 1500 or so individuals who back the London reinsurance giant.

Except in this case very few of the “names” knew what they were buying. And nobody has any idea how many were sold, or with what total face value.

It is known that some $2 billion was sold to charities and municipal councils in Australia, but that is just the tip of the iceberg in this country. And Australia, of course, is the tiniest tip of the global iceberg of synthetic CDOs. The total undoubtedly runs into trillions of dollars.

All the banks did it, not just Lehman Brothers which had the largest market share, and many of them seem to have invested in the things as well (a bit like a dog eating its own vomit).

.

Sunday, November 16, 2008

Hard-earned TRASH for CASH

Karang Guni men assembling the DBS High Notes art installation at Speaker's Corner

Karang Guni men assembling the DBS High Notes art installation at Speaker's Corner When is DBS going to clear up its rubbish?

When is DBS going to clear up its rubbish? Mr Tan Kin Lian can't help but marvel at the DBS Trash at his feet

Mr Tan Kin Lian can't help but marvel at the DBS Trash at his feet A Japanese video news crew is on hand to capture the fight against DBS - HNIG takes the fight to the international scene!

A Japanese video news crew is on hand to capture the fight against DBS - HNIG takes the fight to the international scene!Hong Lim Park 15 Nov 2008

Part 1: http://www.youtube.com/watch?v=B7QKv797cTY

Part 2: http://www.youtube.com/watch?v=wR9lQG94vi4

Part 3: http://www.youtube.com/watch?v=abNYEQT-y0Y

Part 4: http://www.youtube.com/watch?v=PNagLDPTIsc

Interview with Mr Tan: http://www.youtube.com/watch?v=26GKHmbZCzQ

.

Friday, November 14, 2008

Ready to Hit the High Notes?

http://www.youtube.com/watch?v=vrKo5jYYT5I

This was contributed by a blog devotee.

.

Why We Need to be at Hong Lim Park

But for the vast majority of us, we are no nearer a resolution. Much has been achieved, but much more needs to be done.

We must see this contest between us and the bank as a marathon race. We must see that it is a not dash of a hundred meters, for we cannot finish a marathon if we try to sustain the speed of a sprint race. So, we must learn to live our everyday lives, do our work, spend time with our families, take care of our minds and bodies, and go on with the framing of our plans even as we tussle with DBS. However painful the loss, despair must not debilitate us, slow our pace, or weaken our resolve.

Some of you will remember the actor Gregory Peck who carried very memorably the role of Atticus Finch in "To Kill a Mockingbird". He quotes Churchill to illustrate the code that Atticus lives by: "Withhold no sacrifice; grudge no toil; seek no sordid gain; fear no foe: all will be well".

We have asked all of you to be truthful in your letters and interviews. We must not claim what has not happened and what was not said. If the bank will not do the right thing, then we must be the ones who will set the example for them. Be truthful, not fearful. Be not afraid for it is not us who have carried out a wrongful deed - it is not us who must fear.

Some of us may weary from the fight when the end is not easily seen. But the end may be around the corner, and we could have stopped just short. Can we later justify our inactions to ourselves or to our families? DBS has said they are responsible to their shareholders for compensations they make, but are our families not our shareholders, and are we not answerable to our own stakeholders?

"All will be well". If each of us just do our little share, pull our small portion of the weight, push back our part of the wall, then together, big as DBS may be, and small as each one of us is, together we can shame even such a behemoth onto a proper and correct path of action. Because, in the end, we know that we are right, and on their side, they will know they have done wrong.

We hope to see you at Hong Lim Park tomorrow at 4.30pm.

.

Wednesday, November 12, 2008

An Open Letter to Mr Koh Boon Hwee (Chairman, DBS)

Dear Mr Koh

I refer to your recent interview with the Straits Times published in that paper on 12 Nov 2008.

"I believe that we will do things differently"

DBS will earn the thanks of your future customers, at least those intrepid ones who dare risk their funds in releasing them into the tender care of your bank.

But this is small comfort to the affected High Notes customers who have been forced to literally pay the price of DBS's lackadaisical ways of selling products in the recent past. We are the ones to whom the bank has pushed the burden of proof of its own misdeeds.

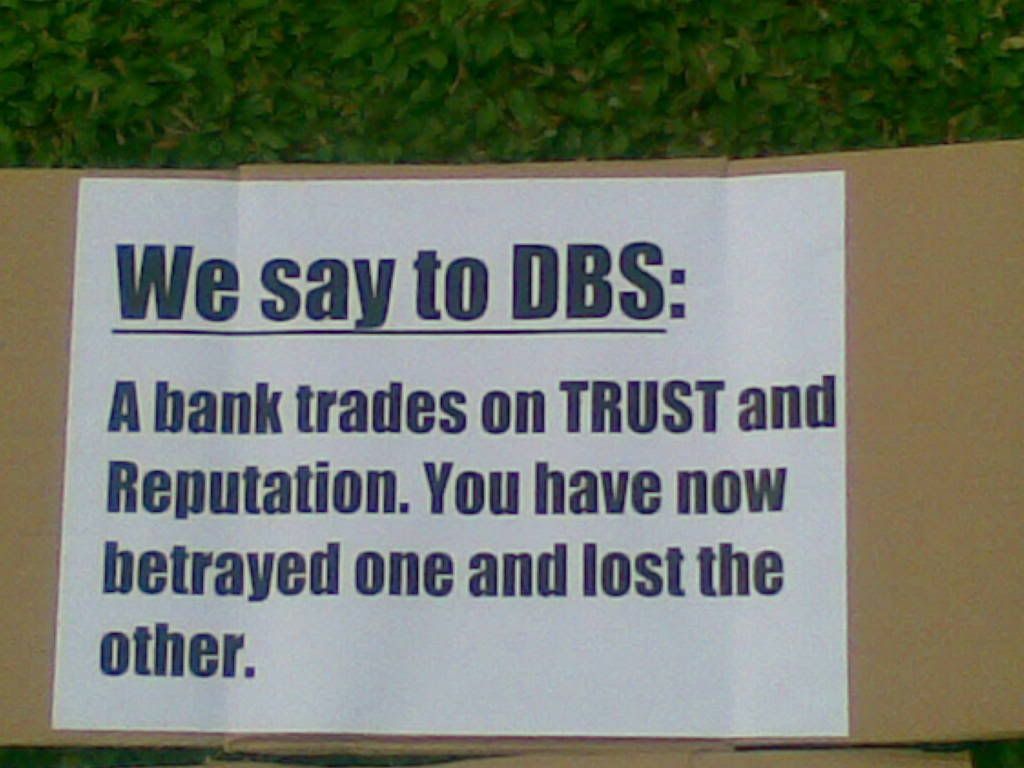

You want now to build a better structure to protect the bank from future accusations of mis-selling and misrepresentations. That is good. But DBS should never have betrayed the trust of its customers who looked to it for a safe haven for their money in the first place. That would have been better.

So the question to DBS is: you made a mistake; people have complained; you have now learned a painful lesson; but why are those who brought this lesson to you the ones to pay the entire price?

"The financial landscape has changed"

Of course it has. But the mark of a person or an organisation is not evidenced by what happens in the better times, but by what happens in the dark ones as well. By all its recent actions, DBS has proved itself to be a fair weather friend, ready with false assurances and a glib tongue, and take our money on a sunny day, but run to the shelter of legal clauses when the storm breaks.

The issue with High Notes is not that Lehman Bros. has collapsed; rather it is about what customers have been told by your representatives when they were selling these products. So, even if it was just one week after the sale, and Lehman is still the darling of Wall Street, we will still have a problem with the unrevealed risks that were never properly explained. Lehman is only the instrument with which this can of worms was opened to public view, and the sight we gained of the product and the inner workings of DBS is not a credit to your bank.

The question to DBS is: when will DBS finally take responsibility for its actions instead of sweeping it under the convenient Lehman rug?

"preface every investment...with a summary sheet"

May we hope that the future summary sheet includes all the facts pertinent to making an informed decision, and not just the positive points as we have seen in various "fact sheets" DBS has put out on High Notes to bait the unsuspecting customer?

I'd like to ask: when will DBS learn from the medical profession, and that is, in treating the financial health of its customers as of the utmost importance, and to give proper advice so that its customers have all relevant information, and not look on customers as just a contributor to the quarterly reporting?

"OCBC and UOB sold preferential shares to investors"

Really, making this argument must surely be beneath DBS. Unlike those preferential shares, DBS's High Notes 5 is now worthless (at least according to DBS). Unlike High Notes whose complexity is beyond even the Relationship Managers to comprehend, those shares are easily understood financial instruments. And unlike High Notes, those preferential shares were not misrepresented.

If High Notes customers had DBS preferential shares instead, we would like to assure you that we will not hold DBS responsible for any losses. But we hadn't, and therefore we will.

A question: will DBS never own up that it has simply sold High Notes to the wrong set of people, never mind who has read what, what is written where, and who has told whom what and when?

"We don't like the fact that people have lost money"

Guess what? We don't either. Especially when the basis of calculating that loss to be a complete one is based on a choice of formulae that needs to be questioned. And questioned closely.

"I'm extremely proud of the people in DBS"

These are fighting words and they will probably cheer the collective hearts of your shareholders in a gloomy time, but do not be surprised that they bring little comfort to your customers, especially those ones to whom you have sold those unfortunate High Notes, and the 900 employees you will be retrenching.

Nowhere in the interview do we read of your sympathy for your High Notes customers, many of whom have been with you for twenty, thirty years, and who because they never thought the "national bank" would play them false, put money in on the strength of that relationship.

Question: can this be any firm foundation to rebuild people's trust in DBS as you say you want to do?

"I can tell you they've taken some abuse"

This is unfortunate. I recall that Mr Rajan Raju appealed for civility during the dialogue sessions. But please understand that when people put money that they have spent long years accumulating, when those funds are their plans for their children, their dreams for their own futures, when those savings may be someone's hopes for a better life, and when they take that money and entrust them to your bank on some given understanding that it will be safe, and when that trust is proved misplaced, and that understanding is turned upon its very head, then please forgive them for being just a little upset.

People in Singapore are very tolerant by nature and are slow to to be riled. But, sir, DBS has played fast and loose with people's lives and they are the ones who have taken much abuse. Do you wonder then at their reactions?

"Many questions are sent heaven-wards, but no answers have yet descended"

.

Tuesday, November 11, 2008

Straight Answers to Your Questions by HNIG

If you have read it and found the information beneficial, you may like to send it on to your family and friends. Hopefully in the future, we can all avoid the pitfalls of such flawed products and selling methods.

The leaflet can be downloaded here -->

HNIG - Straight Answers to Your Questions

.

Saturday, November 8, 2008

Dr Money Looks at HN2

http://www.askdrmoney.com/

Distributors: DBS, POSB

Name of Product: "DBS High Notes 2"

Ad Description: Picture of a lady looking lovingly at a string of pearls

Type of Product: Structured Product

The Bold Claim: "A potential return of 21.5 per cent over 5 years."

The Facts: (i) Return for years 1 to 5 are 3.5 % + 3.5 % + 3.5 % + 5 % + 5 % = 21.5 %. These are the maximum yearly returns.

(ii) The ad does not tell the minimum returns and, as with all structured products, the prospectus does not give enough information to know which is more likely -- the min or max return. Bank sales staff often imply that the maximum return is more likely. In fact, there is no way to know this.

(iii) As with all structured products, the maximum return is limited. The cap is 14 per cent over 3.5 years, which comes to 4 per cent per year. The ad and sales staff give the impression that you are fortunate if you receive this early payout. In fact, the opposite is true. You will receive an early payout only if the fund does exceptionally well. If that happens, the issuer will buy you out, thereby limiting your gain. The remainder of the extraordinary gain (often the bulk of it) goes to the issuer.

(iv) As with all structured products, the return is linked to products and events which are nearly impossible to forecast. In this case, "The performance of DBS High Notes 2 is linked to a basket of 8 international and regional banks, each with a minimum rating of A- by Standard and Poors".

.

Friday, November 7, 2008

How Minibonds (or High Notes) Work

Someone offered this post:

The following is an article I received about the expanation of the machnics of Minibonds. If you read the Minibonds as HN2, the issuer Lehman Brothers as DBS, the 6 reference banks as 8 reference banks in HN2, the Minibonds Ltd as Constellation Investment Ltd in HN2, the 150 entities with 11 defaults as 100 entities with 5 dafaults in HN2, you will get the picture of HN2 is created and worked.

After reading, you will know how we are deceived. As 9 37AM said, "the intention to mislead starts from the design of the product".

Here is the article:

MINIBOND SAGA In BETTER EXPLAINED FORM.....

The name "Minibonds" itself is a misleading word for investors. Whatever money you have invested in this "Minibonds" are not invested in bonds of the six reference banks or bonds issued by Lehman Brothers. This is how it works. Lehman Brothers may or may not buy any bonds from the six reference banks but it is just using these banks as "reference entities", some sort as a "bet" with Minibonds holders. There are basically 5 entities involved in the Minibonds arrangement.

1)First of all, its Lehman Brothers as the credit risk swap partner.

2)Secondly, Lehman Brothers has created an empty shell company Minibond Ltd which will issue the Minibonds to investors.

3)Third, the investors.

4)Forth, the money taken from investors will be invested in a basket of AA financial products from 150 companies which includes CDOs which is basically collateral debts obligations, some of them are related to SubPrime debts.

5) The reference banks which has nothing to do with investors' investment other than being a betting reference: i.e. if any one of them failed, it would be a credit event that make investors lose money to Lehman Brothers.

For simplicity to understand the whole arrangement, just take it that Lehman Brothers has bought some bonds from these six reference entities (banks) and it needs somebody to insure its risk of exposure to these banks. It did not insure its risks from insurance companies like AIG but instead, via this Minibonds arrangement, bought insurance from investors like you.

Through the Credit Risk Swap, you as an investor has agreed to sell insurance to Lehman Brothers with regards to the reference entities. In order to become an insurance agents of Lehman Brothers, you will need to come up with money as collateral. This money is collected from you via the financial institutions that you bought the Minibonds and given to Minibond Ltd to invest in a basket of CDOs issued by 150 companies.

Whatever returns from these CDOs issued by these 150 companies (variable returns) are given to Lehman Brothers. In return, Lehman Brothers will give Minibonds Ltd a FIXED premium (most probably higher than 5.1%) and Minibonds Ltd will give investors 5.1% returns for their investment. Now, the variable returns from the Collateral Assets may be higher or lower than 5.1% but investors will only get back 5.1%. It means that Lehman Brothers will take the risk of variable returns from these Collateral Assets in return for your risk taking on the reference entities. This complete the Credit Risks Swap, swapping your risks of variable returns for a fixed returns, while you in return, insured Lehman Brothers for their risk exposure to the Six reference entities.

The problem is that Minibonds Ltd, under the control of Lehman Brothers, may choose to invest in a higher risk instruments or CDOs because it would be very profitable if the returns from these investment is higher than 5.1% that Lehman Brothers promised you. Especially so, when they do not need to bear the risks of defaults these CDOs or any of the assets in the basket of Collateral Assets. The returns from these Collateral Assets, they take but you bear the risks of defaults from these assets. Under the contract, once a CREDIT EVENT happens, the whole arrangement will be liquidated. The Credit Event involves:

1) If any one of the reference banks failed, it is considered as a Credit Event and the investors will have to pay Lehman Brothers for the insurance it bought via the Credit Risks Swap. Meaning, investors will lose all money invested.

2) If more than 11 companies of the 150 companies listed in the Collateral Assets failed, or a certain percentage of the CDOs or credit-linked derivatives held as Collateral Assets go into default, the

whole Minibonds will be liquidated and any loss from these defaults will be born by investors (not Lehman Brothers).

But the definition of Credit Event does not includes the failing of Lehman Brothers as the Credit Risks Swap partner. Thus, at this moment, investors do no face immediate liquidation of the Minibonds and suffer immediate losses. However, investors RISK losing a lot of money due to the fact that the value of the basket of CDOs and other credit-linked derivatives held as Collateral Assets has devalued tremendously due to the present financial crisis. The likelihood of a credit event triggered by the failing of a substantial number of companies within the list of 150 is very high at this moment.

Furthermore, as Lehman Brothers has gone into bankruptcy, it will no longer give you the 5.1% as it promised and in this financial crisis, the variable returns from the basket of CDOs and credit-linked derivatives would be nearly zero as most of them are linked to SubPrime products.

1) What was sold to the unsuspecting and gullible investors ? Is it a Credit Default Swap( CDS ). What is a CDS ?

Credit Default Swap, also commonly known as Credit Risk Swap, is a mechanism whereby two parties "exchange risk". In this case of Minibonds, it is totally an UNFAIR swapping. The "RISK" Minibonds Investors swapped with Lehman Brothers is the VARIABLE RETURNS from the basket of Collateral Assets they implicitly invested via Minibonds Ltd controlled by Lehman Brothers. However, the risk of the failing of the whole basket of Collateral Assets are not insured by Lehman Brothers. Thus, Lehman Brothers will not compensate investors if they lose money due to defaults of the CDOs and

credit-linked assets held in the basket of collateral assets!

This is where the tricky part is. Lehman Brothers could use Minibonds Ltd to invest in many HIGH RISK financial derivatives to get very high variable returns and it will benefit from these returns while only giving back a fixed 5.1% to investors. But if these HIGH RISK derivatives failed, investors will have to bear the brunt. On the other hand, Lehman Brothers has used the Six Reference banks as a risk bet to Minibonds investors. It seems to me that using such reference entities of "Low Risk" nature as Credit Default Risk exchange is MISLEADING as it creates an impression of "LOW RISKS" while in fact, the amount of RISK investors born is very much higher as they are responsible for the risk of the Collateral Assets!

2) What is the purpose of REFERENCE ENTITIES ( REs ) ?

The REs are prominently displayed in the brochure and fooled us into thinking we are investing in their bonds. As explained, the Reference Entities are just a reference of "Risk" that Lehman Brothers is swapping with you. Your money invested did not invest in these banks but rather in a list of 150 companies' credit-linked derivatives which may be of HIGH RISKS nature. The main Risk that investors is taking lies in the basket of Collateral Assets.

3) The money collected from investors, what did they do with it.

The money collected from investors are invested in a basket of HIGH RISK derivatives issued by 150 companies. High risk derivatives may give high VARIABLE returns but the returns from these High Risk derivatives was swapped by the arrangement of CREDIT DEFAULT SWAP, to Lehman Brothers. That means that investors are bearing the HIGH RISKS of this basket of derivatives (not bonds, but CDOs and credit-linked derivatives) but Lehman Brothers has taken all the returns from these derivatives and in return, only promised to give you a FIXED return of 5.1%!

4) The REs have not defaulted,but the value of our investments have plumetted to almost zero. What is the rationale behind this incomprehensible senario?

Although the REs have not defaulted but the basket of HIGH RISK derivatives that your money actually invested in as a basket of Collateral Assets has actually diminished due to the financial crisis that we are facing. Although you as investors have not enjoyed the high returns from these high risk derivatives (which you have swap and given to Lehman Brothers for 5.1% return) but you bear the risks of defaults or devaluation from these financial derivative instruments.

5) Did the distributor :- a) misrepresented this product ; b) concealed the material fact ?

a) From the many descriptions given by investors with regards to the information they received from sales representatives, it is a CLEAR MIS-INFORMATION and MIS-REPRESENTATION of this product. The RISK you faced is not LOW as the failure of any one of the six reference entities. You, as an investor, also face risk of defaults or devaluation of the basket of HIGH RISK financial derivatives issued by the 150 companies and yet, you did not enjoy FULLY the potential high returns from these instruments but taking the risk of these instruments!

Basically it means that, somebody used your money to invest in HIGH RISKS products and keep all the potential HIGH RETURNS from your investment but in return, they only give you back a FIXED 5.1% and you bear all the risks of defaults and devaluation of these products. I believe if this is represented properly to you, many investors would not be investing in this product. I mean, who wants to bear all the HIGH RISK while taking back only a FIXED 5.1%?

b) I am not in the position to say whether "they knew but did not tell you" or they conceal any material facts because I am not vested and would not know whether those front line sales representatives actually know what they are selling in the very first place. I believe not many people really understand this Lehman Brothers Minibonds when it was first sold. If those financial elites at MAS actually study the whole structure carefully, they would realize that this Minibonds is DETRIMENTAL to consumers' interests and it is a totally UNFAIR Credit Default Risk Swap as Lehman Brothers controlled the Swap Party Minibond Ltd.

---End of the article.

November 6, 2008 11:21 PM

.

Wednesday, November 5, 2008

Complaint about the DBS Rejection Letters

I have made a complaint thru the phone (62255577) and email

(consumers@mas.gov.sg) to MAS regarding the outright std rejection letters from DBS. I hope those of you who have recd the rejection letter will do same.

November 5, 2008 2:58 PM

.

Monday, November 3, 2008

More videos of 1 Nov Rally

Part 1: Video clip 1

Part 2: Video clip 2

Part 1 (Mandarin): Mandarin 1

Part 2 (Mandarin): Mandarin 2

From Zhi Yuan:

Mr Goh Meng Seng's speech has been uploaded already.

You can watch the video here: Clip

.

Sunday, November 2, 2008

Info on the 1st Nov 2008 Rally

Hi all,

The field report and videos of Mr Tan Kin Lian's speech today have been uploaded to youtube.

Please forward the links to your mailing list:

“I think from what I hear, many investors going to complain to the financial institutions and many cases come back and the financial institutions say ‘no case’. If it is going to be like that, then I think we better spend $120 to file a statutory declaration.”

“Some of you go to my blog, you can also get a complaint form from my blog, can download and print out yourself.”

“I also suggest all the groups depending which financial institutions you buy from sign a lettter asking the financial institutions top management for a meeting.”

Watch the video of Mr Tan Kin Lian's speech here:

Part 1: Video clip (Part 1)

Part 2: Video clip (Part 2)

Pls forward the URLs to everybody you know.

.